IPO Allotment Status: How to Check, What It Means

The Indian stock market has witnessed a surge in Initial Public Offerings (IPOs) in recent years, with retail investors showing unprecedented enthusiasm. But once the IPO bidding window closes, a new wave of curiosity begins: “Did I get the allotment?” That’s where the term IPO allotment status becomes crucial.

In this comprehensive guide, we’ll break down everything you need to know about IPO allotment status—how to check it, what it means, why it matters, and what to do next. Whether you’re a first-time investor or a seasoned trader, this blog will answer all your burning questions.

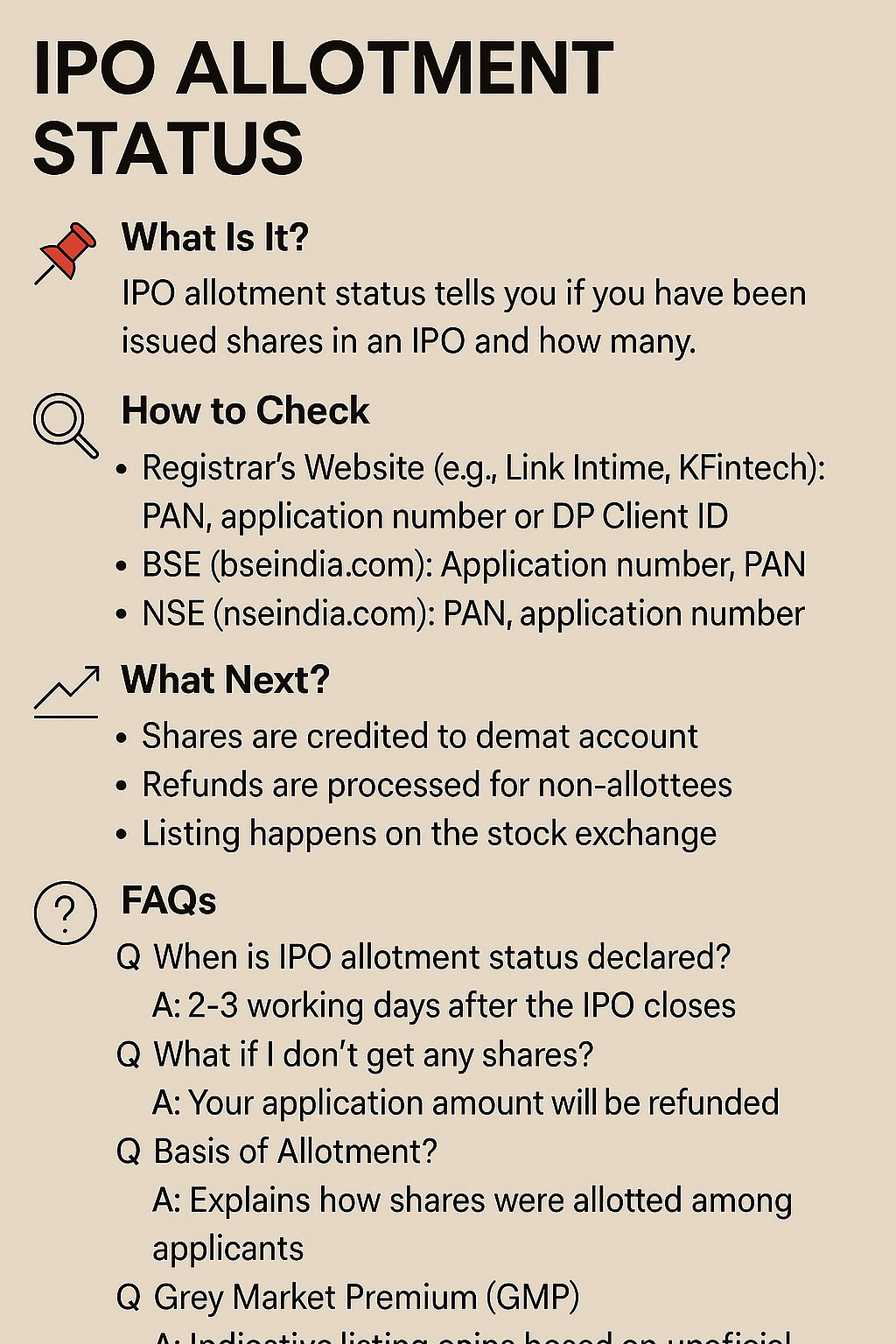

📌 What Is IPO Allotment Status?

IPO allotment status refers to the outcome of your application for shares in an IPO. It tells you whether you’ve been allotted any shares and, if so, how many. Allotment is typically done through a lottery system in case of oversubscription, especially in the retail category.

🧠 Why Is IPO Allotment Important?

- Capital Allocation: It determines how much of your capital is actually invested.

- Refunds: If you don’t get shares, your blocked funds are released.

- Listing Gains: Allotment gives you a chance to benefit from potential listing day profits.

- Portfolio Planning: Knowing your allotment helps you plan your next move—hold, sell, or reinvest.

🗓️ When Is IPO Allotment Status Declared?

The IPO allotment status is usually declared 2–3 working days after the IPO closes. For example, if the IPO closes on a Friday, the allotment status is typically available by Monday or Tuesday of the following week.

🔍 How to Check IPO Allotment Status Online

You can check your IPO allotment status through three main platforms:

1. Registrar’s Website (e.g., Link Intime, KFintech)

- Visit the registrar’s IPO allotment page.

- Select the IPO name.

- Enter your PAN, Application Number, or DP Client ID.

- Click on Submit to view your status.

2. BSE Website

- Go to BSE IPO Allotment Status.

- Select Equity as the issue type.

- Choose the IPO name.

- Enter your Application Number and PAN.

- Click Search.

3. NSE Website

- Visit NSE IPO Allotment Page.

- Select Equity and SME IPO bids.

- Enter your PAN and Application Number.

- Click Submit.

💡 Pro Tip: Use the Registrar’s Website First

Registrars like MUFG Intime (formerly Link Intime) and KFintech are the first to publish allotment results. If you want the fastest update, check their portals before heading to BSE or NSE.

📈 What Happens After IPO Allotment?

Once the allotment is finalized:

- Shares are credited to your Demat account (usually within 1–2 days).

- Refunds are processed for non-allottees.

- Listing happens on the stock exchange, typically 5–7 days after the IPO closes.

❓ FAQs: What People Are Searching Online

1. What if I don’t get any shares?

You’ll receive a full refund of your application amount. The funds are unblocked from your bank account automatically.

2. Can I increase my chances of IPO allotment?

Applying through multiple Demat accounts (within SEBI guidelines) and avoiding large bids in the retail category can improve your odds.

3. Why is my IPO allotment status not showing?

It could be due to:

- Allotment not yet finalized.

- Incorrect details entered.

- Heavy traffic on the website.

4. What is the Basis of Allotment (BoA)?

It’s a document released by the registrar that explains how shares were distributed among applicants. It includes subscription data and allotment ratios.

5. Can I sell IPO shares on listing day?

Yes. Once shares are credited to your Demat account, you can sell them on the listing day if you wish.

6. What is Grey Market Premium (GMP)?

GMP is the premium at which IPO shares are trading in the unofficial market before listing. It gives an idea of expected listing gains.

🧾 Real-World Example: HDB Financial Services IPO

The HDB Financial Services IPO, which closed on June 27, 2025, was oversubscribed 16.69 times. The allotment status was expected to be finalized on June 30, and shares are set to list on July 2. Investors could check their allotment via MUFG Intime or the BSE/NSE portals.

📝 Final Thoughts

The IPO allotment process may seem like a waiting game, but it’s a critical step in your investment journey. Whether you’re chasing listing gains or long-term growth, knowing how to check your IPO allotment status empowers you to act with clarity and confidence.

So the next time you apply for an IPO, bookmark this guide. And remember—in the world of investing, knowledge is your best asset.